Why most startups make terrible investments — and how to spot the “right” opportunity.

Why most startups make terrible investments — and how to spot the “right” opportunity.

Let’s talk about the elephant in the room: why most startups make terrible investments.

It’s not that the ideas are bad, it’s that they often fall into one of two extremes: too small to be exciting or too big to be realistic. It’s like Goldilocks searching for the perfect bowl of porridge — some are too cold (not innovative enough), some are too hot (too risky), and only a few are just right.

Here’s the truth: Finding “right” startups is like finding a unicorn. It’s rare, it’s magical, and it can change your life. But how do you spot one amidst the herd? Fear not, intrepid investor, for I’m here to guide you on your quest.

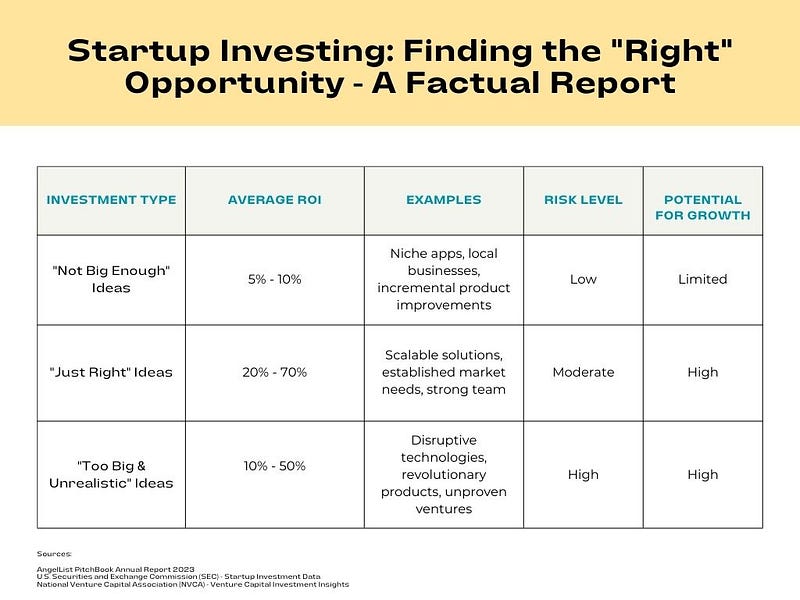

The “Not Big Enough Idea” — The Cold Porridge

Imagine investing in a startup that solves a problem for a tiny audience. It’s like eating cold porridge — not unpleasant, but not exciting. The returns are likely to be lukewarm too, leaving you underwhelmed and hungry for more. These startups may be safe bets, but they lack the potential for explosive growth that makes investing so thrilling.

The “Right” Idea — The Goldilocks Porridge

The startup with a vision that’s both audacious and achievable. It’s like finding a bowl of porridge that’s just the right temperature — warm and satisfying, with the potential to leave you wanting more. These startups are the ones that truly excite investors. They offer a clear solution to a significant problem, have a solid team backing them up, and demonstrate the ability to scale and grow.

But you will ask me, “But what if we set big goals? Is it possible to fit into the ‘right’ category?”

The “Too Big and Unrealistic” Idea — The Hot Porridge

Now, imagine investing in a startup with ambitions as big as the Milky Way. It’s like trying to eat scalding porridge — a recipe for disaster. While their goals might be admirable, their execution plan often lacks substance, leaving them vulnerable to failure. These startups might be tempting with their promises of astronomical returns, but the risk of them crashing and burning is just too high.

So, how do you find these “right” startups?

- Be a market detective: Dive deep into your chosen sectors, uncovering the unmet needs and hidden opportunities. Research trends, analyze competition, and understand the landscape thoroughly.

- Team matters: Look beyond the bells and whistles — focus on the people behind the idea. Assess their experience, track record, and passion. Are they the ones you trust to turn their vision into reality?

- Scalability is key: Don’t get blinded by short-term wins. Ask yourself, can this startup grow exponentially? Can they reach new markets and introduce innovative solutions?

- Don’t underestimate risk: Be honest about the potential pitfalls and challenges the startup faces. Diversify your portfolio to spread the risk and protect your capital.

- Due diligence is your shield: Scrutinize the startup’s financials, business plan, and traction. Seek expert advice and don’t be afraid to ask tough questions.

My Actionable Tips:

- Pay attention to industries with room for expansion and unmet demand.

- Put money into startups run by seasoned and driven individuals.

- Give priority to new businesses that have a clear route to scalability and viable business plans.

- Diversify your portfolio under your awareness of the risks connected to each business.

- Do extensive research on a startup before investing.

There is no such thing as a hypothetical “right” startup. For those who are prepared to make the necessary effort, it is there and just waiting to be found. You may improve your chances of discovering the unicorn investment that will transform your portfolio by using the concepts of thorough study and deliberate review.

Happy investing and for more such content, get to know us on LinkedIn | Website.