Are There Opportunities for Freelancers in Singapore’s Booming Fintech Sector?

Are There Opportunities for Freelancers in Singapore’s Booming Fintech Sector?

Singapore, renowned as a global financial hub, is witnessing a seismic shift in its economy with the rapid growth of the fintech sector. This transformation isn’t just reshaping traditional banking and finance but also creating vast opportunities for freelancers looking to carve out their niche in this dynamic industry.

From blockchain innovations to digital payments, fintech in Singapore is not merely a trend but a pivotal force driving economic progress. According to the Singapore Fintech Association (SFA), the FinTech workforce in Singapore is forecasted to grow by 30% by 2025.

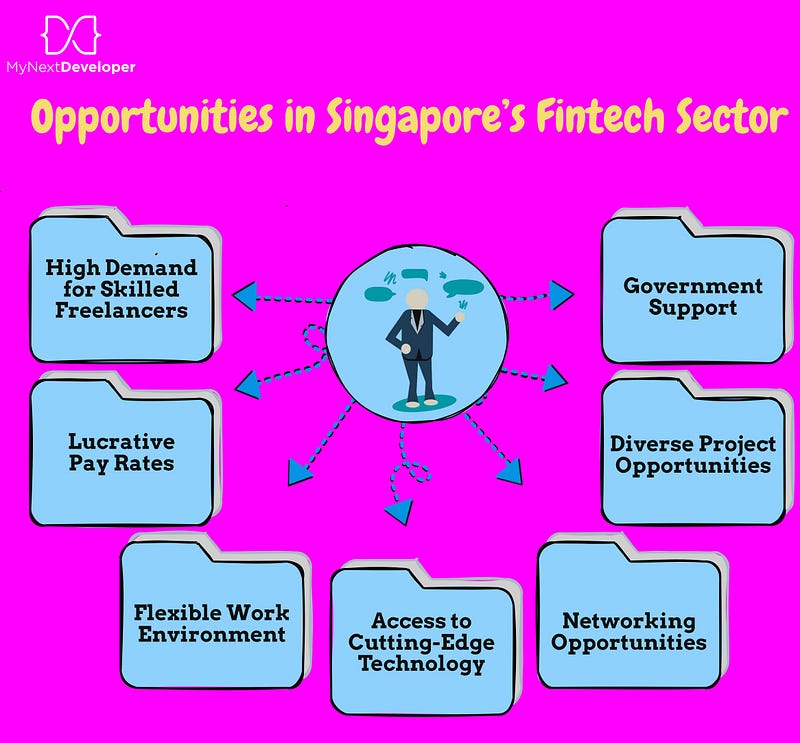

Opportunities in Singapore’s Fintech Sector:

1. High Demand for Skilled Freelancers

Fintech companies need skilled workers. They look for experts in areas like blockchain, AI, and cybersecurity. Freelancers with these skills are in high demand.

2. Lucrative Pay Rates

Freelancers can earn good money in fintech. Companies often pay high rates for short-term projects. This allows freelancers to take on many jobs and maximize their earnings.

3. Flexible Work Environment

Freelancing offers flexibility. You can work from anywhere. This is a huge plus for those who prefer remote work. Many fintech companies support remote work arrangements.

4. Access to Cutting-Edge Technology

Working in fintech means access to the latest tech. Freelancers can work with blockchain, AI, and machine learning. This exposure is valuable for career growth.

5. Networking Opportunities

Singapore is a hub for fintech events. These events are great for networking. Freelancers can meet potential clients and collaborators. This can lead to more job opportunities.

6. Diverse Project Opportunities

The fintech sector covers many areas. These include payments, lending, and wealth management. Freelancers can find projects that match their skills and interests.

7. Government Support

The Singaporean government supports fintech. They offer grants and incentives for innovation. This creates more opportunities for freelancers.

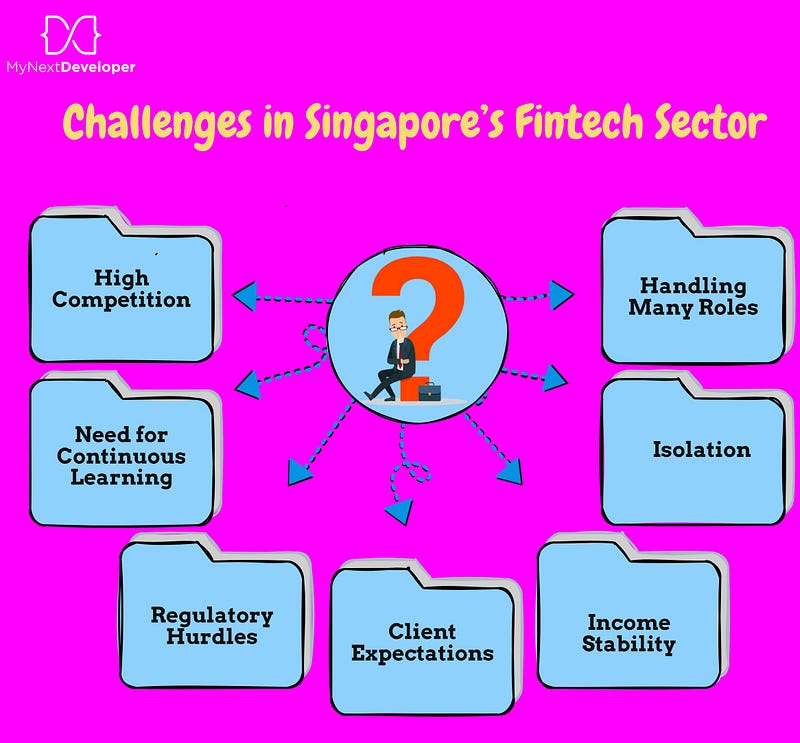

Challenges in Singapore’s Fintech Sector:

Despite its promising prospects, freelancing in Singapore’s fintech sector presents its share of challenges.

1. High Competition

Competition in the fintech sector is fierce. Many skilled freelancers vie for projects in a highly specialized market. Differentiating oneself becomes crucial, requiring freelancers to continuously update their skills regularly.

2. Need for Continuous Learning

Technology evolves faster than we can think. In Singapore’s fast-paced fintech environment, staying competitive necessitates a commitment to upskilling and continuous learning. Freelancers are encouraged to pursue certifications in emerging technologies such as blockchain development, cybersecurity, and fintech regulations. Thus, freelancers must keep their skills up-to-date.

3. Regulatory Hurdles

Fintech companies face strict regulations. Freelancers must understand these rules. Compliance can be complex and time-consuming.

4. Client Expectations

Clients in fintech have high expectations. They demand high-quality work and fast delivery. Meeting these expectations can be stressful.

5. Income Stability

Freelancers may face income instability. Projects can be short-term. There may be gaps between jobs. Managing finances becomes crucial.

6. Isolation

Freelancing can be isolating. Working alone means fewer social interactions.

7. Handling Many Roles

Freelancers wear many hats. They must manage marketing, finances, and client relationships. Balancing these roles can be challenging.

Tips for Succeeding in Singapore’s Fintech Sector

A strong portfolio is essential. Showcase your best work. Highlight projects that prove your skills in fintech. Attend fintech events and meetups. Connect with industry professionals. Networking can lead to job opportunities. Stay updated with the latest trends and technologies. Take online courses. Attend workshops and webinars.

Learn about the regulatory environment. This knowledge is crucial for fintech projects. It ensures compliance and smooth project execution. Plan for income fluctuations. Save for periods when work is slow. Budgeting is key for financial stability. Set boundaries between work and personal life. Take breaks and avoid burnout. A healthy work-life balance boosts productivity. Join freelancer communities. Share experiences and seek advice. Support from peers can be valuable.

Conclusion

Singapore’s fintech sector offers great opportunities for freelancers. High demand, good pay, and access to cutting-edge tech are major perks. But, challenges like competition, continuous learning, and income instability exist. By building a strong portfolio, networking, and staying updated, freelancers can succeed in this booming sector. The key is to balance opportunities with the challenges. This ensures a rewarding and sustainable freelance career in fintech.

The fintech sector in Singapore is a dynamic field. For freelancers, it offers a mix of opportunities and challenges. Success requires a proactive approach. Stay updated, network, and manage your finances wisely. This will pave the way for a successful freelancing career in Singapore’s fintech industry.

Ready to build your tech dream team?

Check out MyNextDeveloper, a platform where you can find the top 3% of software engineers who are deeply passionate about innovation. Our on-demand, dedicated, and thorough software talent solutions are available to offer you a complete solution for all your software requirements.

Visit our website to explore how we can assist you in assembling your perfect team.